- Resources

- Top 11 Fintech Lending Companies in India: Key Services and Customer Ratings

Top 11 Fintech Lending Companies in India: Key Services and Customer Ratings

India has emerged as a global leader in the fintech revolution, boasting a staggering 6,636 fintech companies and a market projected to reach a whopping $150 billion by 2025. This surge isn’t just a number on a chart – it represents a fundamental shift in how we manage our money.

People no longer have to fill documents manually or stand in long lines, waiting for an executive. Instead, fintech is empowering individuals with faster, easier, and more affordable financial solutions. But with the amount of fintech lenders available, right on your smartphone, choosing the right one can be overwhelming.

This is particularly true for those seeking lending solutions, where the lack of transparency and high interest rates can be a significant barrier. However, with the rise of fintech, there are now more options than ever before.

In this article, we’ll be exploring the top 11 fintech lending companies in India, highlighting their key services and customer ratings. So, let’s dive right into it!

In this article, we will explore:

List of Top Fintech Companies in India

According to reports, 75% of surveyed customers are drawn to Fintech’s cost-effective and smooth services, which has greatly increased their digital banking expectations. From mobile wallets and digital payments to online investing and insurance, these companies are revolutionizing the financial landscape in India. Here’s a glimpse at some of the leading fintech companies in India:

| Company | Founders | Valuation |

|---|---|---|

| KreditBee | Madhusudan Ekambaram | USD 700 mn (2024) |

| NAVI | Sachin Bansal, Ankit Agarwal | USD 2 billion (2024) |

| Kissht | Krishnan Vishwanathan, Karan Mehta | USD 500 mn (2022) |

| NeoGrowth | Dhruv Khaitan, Piyush Khaitan | USD 175 mn (2022) |

| Muthoot Microfin | Ninan Mathai Muthoot | USD 446 mn |

| MoneyTap | Puneet Agarwal, Sanjay Aggarwal | USD 131 mn (2020) |

| Faircent | Rajat Gandhi, Juhi Gandhi | USD 27.7 mn (2019) |

| Spandana Sphoorty | Padmaja Reddy | USD 662 million |

| Moneyview | Puneet Agarwal | USD 900 million (2022) |

| Ziploan | Kshitij Puri, Shalabh Singha | USD 49 million (2020) |

| PaySense | Prashanth Ranganathan, Paul Meinshausen, Sayali Karanjkar | USD 134 million (2019) |

7 Advantages of Fintech Over Traditional Banking

Forget waiting in line at the bank because fintech companies are revolutionizing the way we manage our money. While traditional banks have been around for centuries, fintech companies are shaking things up with innovative apps, user-friendly interfaces, and a focus on convenience. Here are 7 compelling reasons why fintech might be the perfect financial partner for you:

| Feature | Fintech Companies | Traditional Banks |

|---|---|---|

| Technology | Cutting-edge technology, agile development | Legacy systems, slower adoption of new tech |

| Customer Experience | Seamless digital experiences, user-friendly interfaces | Often outdated UX, more branch/human interactions |

| Cost Structure | Lower overhead costs, efficient operations | Higher operational costs, branch networks |

| Innovation | Constantly innovating, disrupting traditional models | Often slower to innovate, burdened by regulations |

| Services | Specialized financial services, tailored solutions | Broad range of services, but less specialized |

| Data Analytics | Extensive use of data analytics, personalized offerings | Limited data analytics capabilities |

| Accessibility | Available anytime, anywhere via mobile/web | Limited accessibility, branch hours |

Looking at the table, it is evident that Fintech companies have a clear edge due to their technological advantage, agility, and customer-centric approach. They are disrupting traditional banking models by offering innovative, efficient, and accessible financial services.

Best Fintech Companies in India

1. KreditBee

Online lending startup KreditBee is one of the fastest personal loan providers in the country. The Bangalore-based firm is focused on improving financial inclusion in India via digital lending solutions. The company provides personal loans of up to Rs 5 lakh to salaries of individuals and self-employed persons.

The platform also plans to diversify its product offering by introducing financial services such as insurance, credit score reports, and merchant-side offers. The platform is expected to surpass assets under management (AUM) of USD 1 billion over the next few months. This loan app may be the best financial partner for you if you like quick processing times, competitive interest rates, and a variety of loan possibilities.

What KreditBee Offers:

1. Personal Loan for Self-Employed:

- Tailored for business owners.

- Credit range: ₹10,000 to ₹2 Lakhs.

- Repayment tenures: 4 to 24 months.

2. Flexi Personal Loan:

- Instant credit for urgent needs.

- Amount: ₹3,000 to ₹66,000.

- Flexible tenures: 3 to 10 months.

3. Personal Loan for Salaried:

- Quick loans for salaried individuals.

- Loan amount: ₹10,000 to ₹5 Lakhs.

- Repayment terms: 4 to 24 months.

4. Purchase On EMI:

- Seamless EMI purchases up to ₹2 Lakhs.

- 18-month repayment periods.

| Pros | Cons |

|---|---|

| Competitive interest rates | A few people voiced their displeasure with the customer service |

| Swift loan processing and disbursal | Claims of exorbitant interest rates |

| 100% online, hassle-free documentation |

User Reviews: “Very reliable application. using this for over 3 years. Helped me a lot during financial hurdles. Interest rates were high initially, but due to timely payments, they were brought down to an affordable interest rate.”

2. NAVI

Navi is one of the best fintech companies in India providing home loans and rapid cash loans with appealing features, affordable interest rates, and an easy-to-use interface. Navi provides simple, transparent financial services to meet your various demands, whether you are looking for fast cash or help buying your ideal house.

Additionally, you can get a quick cash loan up to ₹20 Lakh at an interest rate starting from 9% p.a. It is flexible EMI plans up to 48 months make it reliable for everyone. Furthermore, with Navi, you will get quick and hassle-free loan process with minimal waiting time.

| Pros | Cons |

|---|---|

| Starting from 9% p.a. for cash loans | Cash Loan City Limitations |

| No additional charges, full disbursal amount | Age Restriction for Cash Loan- Above 21 years |

| User-Friendly App | Home Loan Secured Borrowing, Requires collateral |

User Review: I required money for my mother’s sudden illness. They were on the way to the hospital, and I was just thinking about where I should send money. Navi app helped me with instant loan.

3. Kissht

Kissht is a renowned loan application in India, available on the Google Play Store. The App lets you apply for loans with 12-month payback terms ranging from ₹10,000 to ₹1,00,000. Making use of credit cards for special deals is one unique aspect.

Only Aadhar Card and PAN Card paperwork are needed for the application’s digital verification. The fintech company also improves consumer convenience and expedites the loan procedure. In addition, Kissht, Line of Credit provides a credit limit for small company transactions based on a QR code. Furthermore, FastCash: In only a few minutes, borrowers can access a revolving line of credit.

Kissht offers loans at an approximate interest rate of 18% annually. User experiences suggest that interest rates vary based on loan amount and repayment time. Generally, shorter repayment periods result in lower interest rates.

| Pros | Cons |

|---|---|

| Easy to Use, ensuring a hassle-free experience. | Users experience app failures, particularly after making payments |

| Borrowers can get quick approval for their loan applications | Customer support provides repetitive and unhelpful responses. |

| Users appreciate the transparency with no hidden fees |

User Review: “This app is awesome! It is super easy to use and has a clean interface. It has all the features I need without any unnecessary clutter. Plus, it is fast and does not drain my phone’s battery. I love how intuitive it is, making it a breeze to navigate and find what I am looking for. Overall, I highly recommend giving this app a try!”

4. NeoGrowth

NeoGrowth Credit is a popular fintech company in lending space. The platform provided instant financial solutions to Micro, Small, and Medium Enterprises (MSMEs). It is an RBI-registered digital lender that takes a technology- and data-driven strategy. As a non-banking financial institution, it concentrates on MSMEs in over 25 cities and 80+ categories. The organization takes great satisfaction in providing businesses with hassle-free and expedient financing, having worked on over a million projects to help them achieve their expansion goals. Therefore, if you have a micro or medium-sized business, you can choose NeoGrowth.

NeoGrowth provides two types of loans:

1. Instant Business Loan

Loan Amount: ₹1 Lac to ₹25 Lacs

Eligibility: Only for Retailers of Goods & Services

Features:

- Completely Digital Application

- Collateral-Free Business Loan

- Instant Approval & Superfast Disbursal

- Daily Repayment Starting at ₹250/Lac

2. Large Business Loan

Loan Amount: Up to ₹75 Lacs

Eligibility: For Retailers, Manufacturers, Distributors & Service Providers

Features:

- Collateral-Free & Collateral-Based Options

- Minimum Documentation & Doorstep Service

- Hassle-Free Process & Quick Disbursal

- Flexible Repayment Options

| Pros | Cons |

|---|---|

| Hassle-free loans | Limited customer service knowledge |

| Unique product offering | Complex documentation and Credit/Debit card demand Short repayment time |

| Support for SME sector |

5. Muthoot Microfin

Muthoot Microfin stands out as a leading institution committed to providing financial inclusion to underprivileged individuals in rural areas of India.

Serving as the Muthoot Pappachan Group’s microfinance division, Muthoot Microfin focuses on lending small amounts of money to female business owners, particularly those in rural areas. Integrity, collaboration, and excellence are among the institution’s key principles, which have shaped its more than 133-year history.

Muthoot Microfin provides three types of loan solutions.

1. Livelihood Solutions

Objective: Provide income-generating and dairy loans to support economic development and empower women entrepreneurs.

2. Health and Hygiene Loans

Initiative: Offering loans to improve home health and hygiene standards, including water purifier loans.

3. Life Betterment Solutions

Diverse Offerings: Education loans, mobile phone loans, solar lighting product loans, bicycle loans, and pressure cooker loans aimed at improving lives in rural areas.

| Pros | Cons |

|---|---|

| Offers creative products for livelihood health and life improvement in disadvantaged communities. | Specific loan details may need a visit to the website or third-party platforms. |

| Borrowers can get quick approval for their loan applications. | Rural focus may hinder access for individuals in remote areas. |

User Reviews: “I was introduced to Muthoot Microfin by a friend. Impressed by the organization’s simple procedures, Sindhu immediately availed her first cycle loan of ₹ 20,000, and since then, she has not looked back.”

6. MoneyTap

The goal of MoneyTap, an app for loans just released in India, is to transform quick loan processing for those with jobs. You may manage crises with a personal line of credit from MoneyTap, and the application procedure is renowned for its quick approval.

The program takes pride in having less documentation. The fintech firm streamlines the procedure via its official website or mobile app. MoneyTap can help with various financial demands, such as weddings, vacations, unexpected medical bills, house remodeling, and auto repairs.

Depending on the loan amount, users can choose a flexible payback period that ranges from two months to three years.

Qualification Standards

To use MoneyTap’s services, you need to fulfill certain requirements:

- Paid or work for yourselves

- Earning at least Rs 20,000 a month

- A minimum of 23 years old

- Living in a city where MoneyTap works (such as Chennai, Delhi NCR, Mumbai, etc.

Protection of MoneyTap

MoneyTap prioritizes security and abides by stringent RBI regulations. The app has received recognition from respectable outlets like CNBC, Times of India, and The Hindu Business Line, and its banking partners likewise follow RBI criteria.

| Pros | Cons |

|---|---|

| Pay interest only on the utilized amount. | Challenges and lack of transparency in closing loans. |

| Instant personal loan with UPI transactions. | Unresponsive support |

| Fully digital, paperless process. |

“Good services after completion of documents immediately transferred money into the bank account but too much interest and emi period very less.”

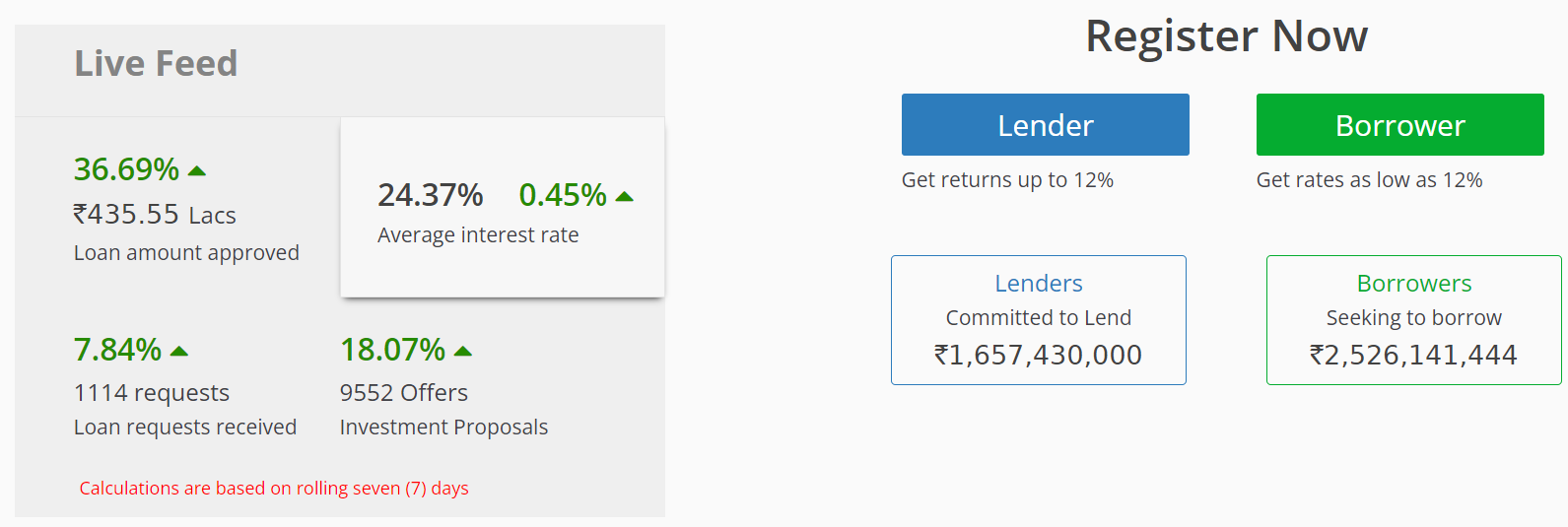

7. Faircent

Faircent is India’s original peer-to-peer (P2P) lending platform. It was the first to get a Certificate of Registration (CoR) from the Reserve Bank of India as an NBFC-P2P. The platform’s primary goal is to create a marketplace that links borrowers and lenders, using technology to expedite procedures and cut expenses.

Lenders are encouraged by Faircent to engage in P2P lending as a substitute for traditional investing options. Faircent offers lenders more returns than conventional models by cutting out middlemen and putting lenders and pre-verified borrowers directly in contact. Both lenders and borrowers benefit from the platform’s ability to generate additional revenue on idle capital.

With its ground-breaking P2P lending approach and RBI recognition, Faircent stands out in the financial market. Faircent fosters an environment where lenders can make attractive returns and borrowers receive access to faster and less expensive financing by using technology and reducing middleman expenses. People are urged to register on Faircent and become a part of this developing financial ecosystem to learn more about this opportunity where every % matters.

| Pros | Cons |

|---|---|

| Helpful in obtaining a business loan | Some users reported financial loss |

| Seamless Fintech customer support |

User Review: “This website helped me with business loan and am happy with the service. Customer support is very soft-spoken and cooperative. I felt very comfortable dealing with them. Thank you, Faircent!”

8. Spandana Sphoorty

Spandana Sphoorty Financial Ltd is a shining example of empowerment, especially for marginalized groups like women. The fintech company hopes to improve the lives of its clients through its microfinance programs and commitment to social upliftment. The “WE” idea embodies a common path toward empowerment, cooperation, and success.

Spandana Sphoorty uses social underwriting to provide financial support as part of the Joint Liability Group (JLG) microfinance concept. This concept promotes a financially inclusive atmosphere, enabling borrowers to begin at zero. In addition, their financial services are conveniently delivered to consumers’ doorsteps, saving them time that would have previously been spent visiting banks.

Furthermore, the company offers loan packages that prioritize sustainability while meeting the changing demands of its clients. Their dedication is demonstrated by creating financial solutions that help borrowers flourish over the long term and meet their current needs.

| Pros | Cons |

|---|---|

| The company focuses on serving marginalized communities, providing low-interest loans with small EMIs | No specific drawbacks are mentioned |

User Review: “This loan firm provides long-term cheap credit rates to farmers, peasants, and the impoverished. Little EMI.”

9. Moneyview

Moneyview stands out as a platform that simplifies the personal loan application process, emphasizing speed, transparency, and flexibility.

1. Instant Approval of Loans:

Moneyview promises to approve loans quickly, giving customers the money, they want in minutes. The focus on speed guarantees consumers fast access to cash when needed.

2. The Largest Loan Sums

Moneyview uses a credit model to provide each borrower with the most customized loan offer possible. A large loan amount is available to borrowers, offering them financial alternatives that meet their needs.

3. Adjustable Loan Terms

It is flexible for borrowers to select loan terms between three and sixty months. Thanks to this option, people may choose a repayment plan based on their preferences and financial position.

4. Open Methodology

At Moneyview, openness is a fundamental principle. There are no hidden costs because borrowers may view interest rates, loan periods, and total payback amounts upfront. This dedication to lucidity guarantees that consumers comprehend their financial obligations.

5. A Stress-Free Interface

Moneyview app is easy to use and streamlines complex procedures by fusing technology and human experience. Borrowers can expedite the application process by just tapping their way through it.

6. Millions of Trustees

The platform’s extensive national reach strives to simplify and make loans easily accessible. Moneyview’s large user base—millions of downloads, thousands of loans given, and services offered in several locations—demonstrates the faith that has been placed in it.

| Pros | Cons |

|---|---|

| Quick access to cash with rapid loan approval. | Concerns about deductions and penalties for non-payment. |

| Personalized, substantial loans based on credit profile. | Customer Service – Mixed reviews highlight the need for consistent support. |

| Clear terms, interest rates, and total loan amounts upfront. | |

| Widely trusted with millions of downloads and successful loans. | |

| Easy Application |

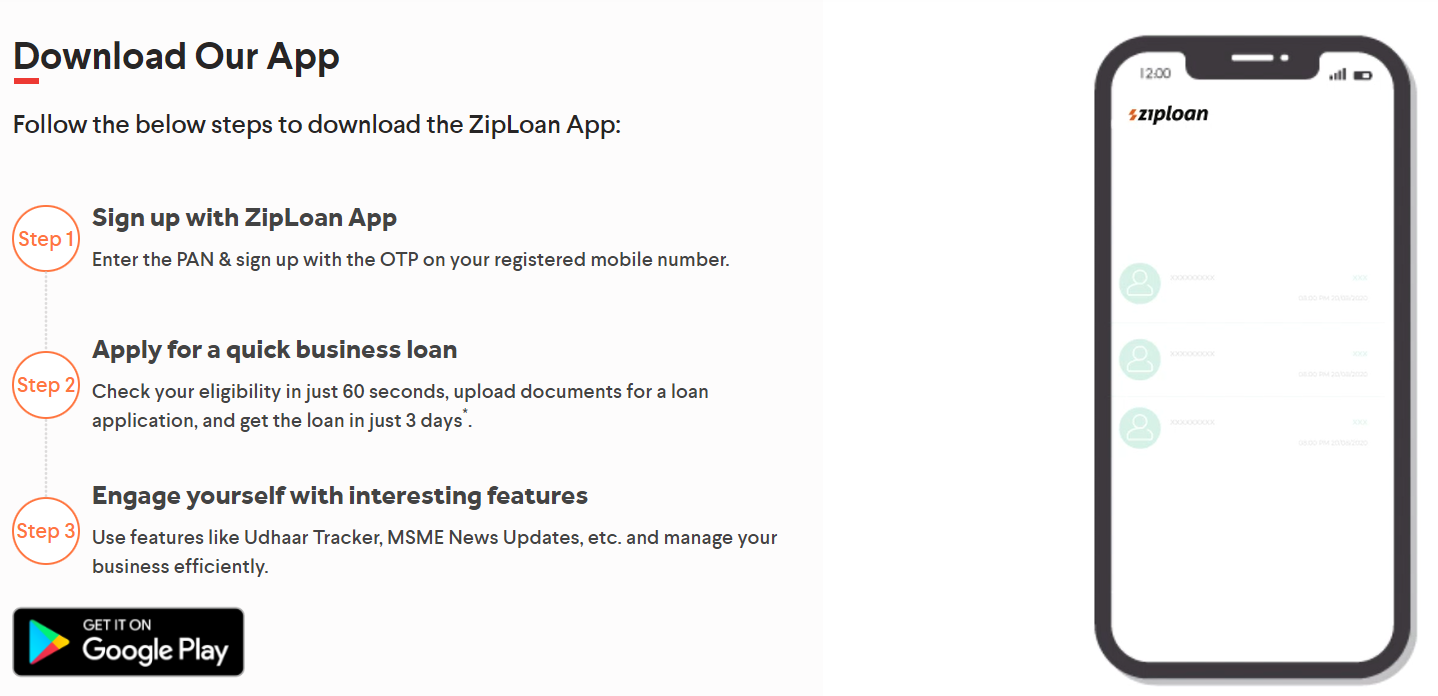

10. Ziploan

For small and medium-sized enterprises looking for speedy loans with less paperwork, ZipLoan presents a viable option. The fintech company’s appeal is increased by the variety of repayment choices and the lack of prepayment penalties. Before selecting ZipLoan as their financial partner, you should carefully consider their eligibility, loan amount criteria, and regional coverage.

Key Offerings:

Fast Business Loans: Loans up to Rs. 7.5 lakhs are handled in 3 days* to meet your urgent financial needs.

Minimal Documentation: One of ZipLoan’s unique features is that it does not require a lot of complicated paperwork.

Flexible Repayment Options: Business owners may match repayments to their income cycles by selecting a flexible tenure option, which ranges from one to three years.

Technology-Driven Approach: By utilizing an online platform, ZipLoan streamlines the loan application process and enables individuals to apply from any location.

No Prepayment Fees: Borrowers are not charged extra to make prepayments after the first six EMIs.

Wide Reach: ZipLoan offers a vast and diversified customer base, serving 10,000+ firms in 70+ industries while operating in more than 6 locations.

| Pros | Cons |

|---|---|

| Streamlined application with minimal paperwork. | Not ideal for substantial financial needs. |

| Loans disbursed in just three days* for urgent needs. | Service availability limited to certain cities. |

| Variable tenures (12, 18, 24, 36 months) align with cash flow. | Criteria may be challenging for newer/smaller businesses. |

| No Prepayment Charges: Freedom to prepay after initial six EMIs. | |

| Rs. 1L to Rs. 7.5L caters to diverse needs. | |

| Convenient Online Application |

11. PaySense

One of the first fast loan providers in India, PaySense meets a variety of demands, including those related to weddings, house improvements, car purchases, and more. PaySense stands out for its unwavering dedication to maintaining a safe and secure system that makes it easy for consumers to get loans.

In the Indian fintech scene, PaySense is a prominent participant that provides a variety of loans with an emphasis on accessibility and ease of use. The majority of users praise the platform’s effectiveness, despite some experiencing delays and problems with customer care. Before selecting a fintech partner, prospective users should evaluate the advantages and disadvantages and take into account their unique demands, just as with any financial choice.

Features:

Quick Loans for Personal Use: The loan range is ₹5000–₹5 lakhs.

Fast Disbursements & Approvals:

Quick loan approval and quick deposit of cash into your account

Electronic Documentation:

digitally supplied KYC papers for a smooth transaction

Cost-effective EMI Plans:

Manageable EMI schedules with auto-debit capabilities and reminders

One-Click Loans That Come After:

Applying for a new loan is simple and requires little paperwork.

| Pros | Cons |

|---|---|

| Easy-to-use application procedure | Interest rates that are somewhat above the norm for the market |

| Document pickup at your door for greater convenience | Despite early assurances, some consumers complained about payment delays. |

| Automatic payments and timely reminders | |

| Various loan possibilities, such as consumer, auto, personal, and more |

User Review: “Very useful app with great experience as I am also a mobile app developer & I do understand how difficult it is to match the user expectation, but the team of this app have done a great job.”

Fintech Contact Centers Enhancing Customer Experience

Numerous fintech companies in India rely on robust contact center platforms as the frontline for customer interactions. Financial services contact centers efficiently handle inquiries, provide support, and ensure smooth transactions, enhancing overall customer satisfaction. Fintech firms also harness cutting-edge technologies such as AI, ML, and data analytics to elevate the user experience. These platforms ensure compliance with regulatory standards, offer personalized assistance, and play a crucial role in building trust among users. The synergy of technology and human touch in fintech contact centers contributes significantly to shaping a positive and reliable customer journey.

In Conclusion

The Indian fintech landscape is booming, fueled by innovation and a focus on empowering individuals. Also, there are various fintech companies offering a range of features to customers to effortlessly navigate the world of financial services. In this article, we have explored the best Indian fintech lending companies that are revolutionizing the market by providing shorter payback terms and easier loan applications.

By exploring these platforms, you can choose the one that best aligns with your financial needs and goals. Also, as the fintech sector continues to evolve, it’s clear that proptech, edutech, and healthtech innovations will play a crucial role in shaping the future of financial services.

Ready to take control of your call transfer

experience for better CX outcomes?

Prashanth Kancherla

Chief Product Officer, Ozonetel Communications

Over the past decade, Prashanth has worked with 3000+ customer experience and contact center leaders...

Chief Product Officer, Ozonetel Communications

Over the past decade, Prashanth has worked with 3000+ customer experience and contact center leaders to comprehensively understand the need for effective and efficient customer communications at every step of their journey with a brand. Deeply embedded in today’s CCaaS ecosystem, he has been instrumental in Ozonetel's growth and contributed in various roles including product management, sales, and solution architecture.