- Resources

- Voicebots in Banking: A Complete Guide

Voicebots in Banking: A Complete Guide

Banks today manage millions of customer conversations across queries, payments, reminders, and feedback. Voicebots help simplify this. They automate phone-based interactions, respond instantly, and reduce the load on contact center teams.

In this guide, you’ll learn what voicebots are, how they work in a banking setup, and the exact use cases they’re being used for—like loan collections, KYC follow-ups, and service requests. Keep reading to know more!

What is Employee Experience?

Employee Experience (EX) is the overall perception employees have of their journey within an organization. It encompasses every interaction and touchpoint, from recruitment and onboarding to daily responsibilities, support systems, and eventual offboarding.

What Are Voicebots in Banking?

AI Voicebots in banking are AI-powered virtual agents that handle customer conversations over phone calls, without human intervention. They understand spoken language, respond with pre-defined or dynamic replies, and complete tasks by integrating with backend banking systems.

These bots are used across both inbound (when a customer calls the bank) and outbound (when the bank reaches out to a customer) touchpoints. They can verify identity, share account information, assist with transactions, trigger reminders (like EMI due dates), and even capture feedback or complaints.

Unlike simple IVR systems, voicebots utilize natural language understanding (NLU) to interpret intent, allowing customers to speak naturally instead of pressing numeric options.

How Voicebots Work in Banks?

Voicebots are deployed at high-volume customer interaction points across inbound support, outbound campaigns, and service workflowsHere’s how it works:

- Customer Verification: Bots can authenticate customers via mobile number, OTP, or simple knowledge-based questions, just like an agent would.

- Query Resolution: They respond to requests like “what’s my EMI due?”, “What’s my account balance?, or “How can I update my KYC?” by fetching real-time data from banking systems.

- Process Initiation: Beyond just providing information, bots can initiate flows—sending payment links, collecting feedback, generating tickets, or scheduling callbacks.

- Intent Recognition and Escalation: They detect keywords, tone, and context to determine if the issue requires human intervention. If yes, they hand off the customer to the right team, along with the interaction history.

- Post-call Actions: Calls are logged, transcripts are stored, and outcomes (e.g., “KYC confirmed”, “payment promised”) are recorded back in the CRM for continuity.

Advantages of Implementing Voicebots in Banking

AI voicebots reduce leakage, increase responsiveness, and close compliance gaps across the banking funnel. Some key advantages of implementing voicebots in banking are:

- Scale Without Increasing Headcount: Voicebots can handle thousands of concurrent calls—useful during billing cycles, new product launches, or compliance deadlines—without overloading contact center teams.

- Reduce Lead Leakage & Follow-up Delays: Whether it’s loan callbacks, card activations, or missed EMI collections, bots help initiate timely outreach within minutes, not hours. This shortens response windows and improves conversion.

- Improve First Contact Resolution: By instantly answering high-volume queries (account information, document status, product FAQs), bots help resolve more issues on the first call, reducing repeat contacts.

- Streamline Compliance Workflows: Bots can handle routine yet compliance-critical workflows, such as KYC updates, regulatory disclosures, or consent capture, with time stamped records and audit trails, ensuring seamless compliance.

- Personalize at Scale: Voicebots can reference past interactions, language preferences, or transaction history to make conversations feel tailored, important for improving retention and NPS.

- Lower Operational Costs: By deflecting L1 support and follow-ups, bots reduce agent workload and lower the cost per interaction, especially in high-volume teams such as collections or service.

- Better Data, Faster Improvements: Every call is structured, recorded, and analyzable for enhanced insights. Teams gain insight into why users drop off, what concerns are repeated, and where interventions are needed.

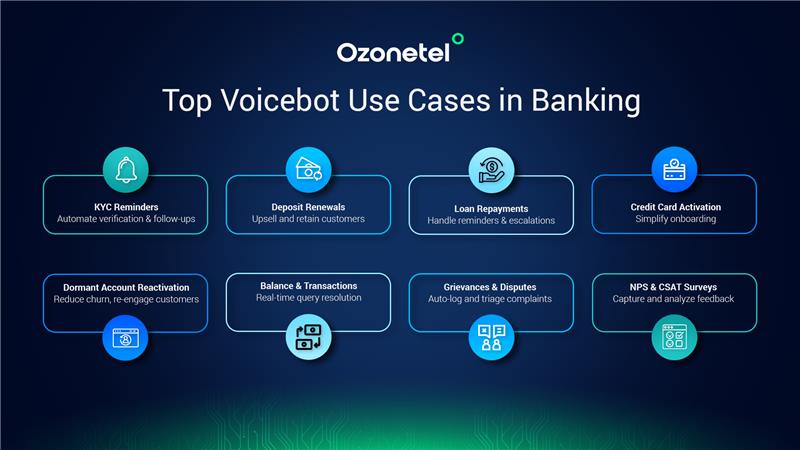

Use Cases for Voicebots in Banking

Voice AI agents help banks scale routine conversations with speed and context. From automating KYC reminders to reactivating dormant users, voicebots reduce agent workload and drive better outcomes across the customer lifecycle.

Let’s break this down with use cases that banks are already running:

KYC Reminders

Regulatory compliance is non-negotiable, but banks often waste time and resources chasing customers for Know Your Customer (KYC) completion. Voicebots can simplify this. Instead of bulk SMS reminders, they initiate calls, confirm receipt of documents, and prompt action, without requiring agent intervention.

These interactions are fast, language-friendly, and trigger CRM updates in real-time, making compliance a lot less chaotic. For example, HDB Financials automated 70% of their support queries—including KYC follow-ups—using Ozonetel’s self-service IVR. This resulted in a 5% decrease in TAT and a 10% improvement in agent efficiency.

Deposit Renewals & Upsells

When fixed deposits or recurring deposits near maturity, timing is everything. Voicebots can proactively reach out, educate customers on renewal benefits, and even suggest higher-interest products.

These calls feel natural and personalized, especially when integrated with past deposit history. For high-value customers, the bot can route directly to a relationship manager, converting a routine renewal into a revenue opportunity.

A leading NBFC utilized Ozonetel auto dialers to execute personalized voice blast campaigns targeting loan top-ups and deposit renewals, identifying high-intent users and instantly connecting them with agents. This strategy achieved a 10% conversion rate on voice campaigns, 3 times higher than previous efforts.

Loan Repayment & Collections

Repayment reminders, NACH bounce alerts, or even restructuring offers can be handled at scale using voicebots. These bots can provide repayment links, capture intent to pay later, or escalate to an agent based on keywords like “dispute” or “financial hardship.” This triage improves resolution while maintaining a tone of empathy.

For instance, HDB Financials enabled agents to pitch additional products during these repayment calls, powered by Ozonetel’s ‘multi-cross-sell’ feature. This helped them run 2 lakh+ conversations daily and improved cross-sell conversions across personal, auto, and gold loans.

Credit Card Activation

Getting customers to activate and use their credit cards quickly is crucial to long-term retention. Voicebots can follow up after delivery, guide users through activation steps, and highlight key features of the card. For first-time users, they can also simplify PIN generation or link activation to mobile apps. It reduces abandonment and speeds up the onboarding process.

Dormant Account Reactivation

Voicebots are particularly effective in re-engagement campaigns. They can reach out to inactive users with personalized messaging based on their last product interaction. If the user responds with interest, the bot can capture new service preferences or set up callbacks. This model not only reduces churn but also reactivates revenue streams.

Account Balance & Transaction Support

A significant portion of daily banking queries revolves around balances, recent transactions, or mini-statements. Voicebots can resolve these instantly, in regional languages, without any wait time.

When linked with the core banking system, they provide secure, real-time updates. This frees agents for more valuable interactions and keeps call center costs in check.

The same NBFC, for instance, automated 50% of its inbound queries (including balance and EMI queries) through multilingual voicebots. IVR adoption grew because users also got updates on their request status via WhatsApp, reducing dependency on agents

Grievance & Dispute Capture

Instead of routing every grievance to an agent, voicebots can efficiently log and categorize issues. They can ask guided questions, assign tags such as “billing,” “transaction delay,” or “service dissatisfaction,” and automatically create tickets in the CRM. This ensures no complaint is missed and follow-ups are faster and more accurate.

HDB integrated this model, which auto-generated tickets and summaries post-call, helping them achieve a 90% first-call resolution rate even at high volumes.

NPS & CSAT Surveys

Feedback captured immediately after an interaction is far more reliable. Voicebots can run short surveys, such as “How would you rate your service on a scale of 1 to 5?”—and analyze responses using tone and keywords to provide insights. When scores are low, alerts can trigger for human callbacks. It’s a closed feedback loop that improves fast.

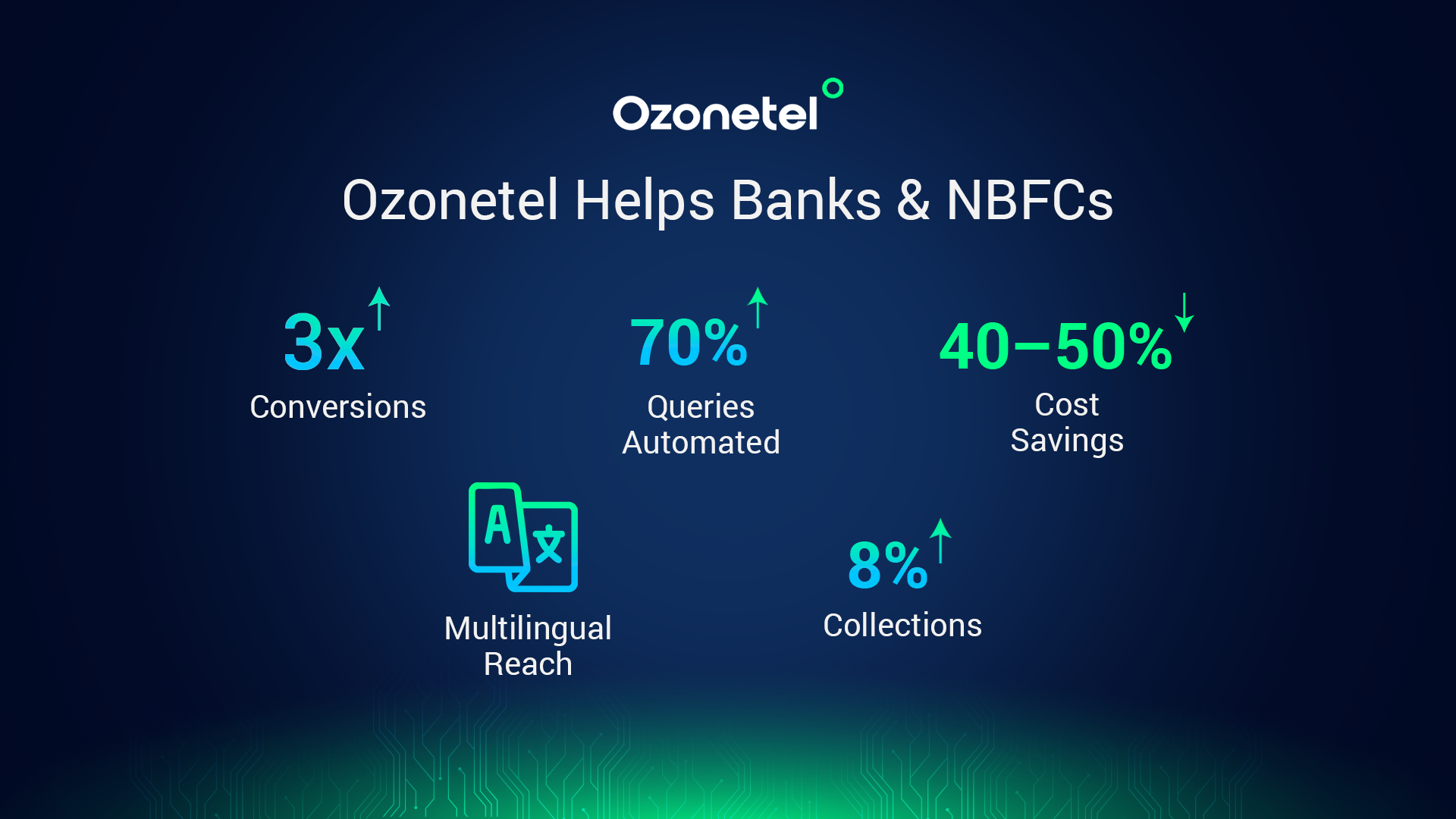

How Ozonetel Helps Banks & NBFCs

Banks and NBFCs need more than automation—they need outcomes. Ozonetel offers a full-stack voice AI and contact center platform that plugs directly into your core banking systems, CRMs, and compliance workflows. Here’s how it supports real, measurable impact:

1. Faster Lead Conversion

Deep dialer-CRM integration (e.g., with LeadSquared, SugarCRM) ensures that every digital lead receives a call within 15 minutes. NBFCs using this setup have achieved 3 times higher conversion rates and completed over 10 million monthly sales calls without delay.

2. Automated Query Resolution

50–70% of customer queries—ranging from loan statements to KYC status—are now handled via self-service IVR or voicebots. This not only saves agent bandwidth but also reduces turnaround time by up to 5 days in some high-volume environments.

3. Improved Collections Efficiency

Collections workflows are automated end-to-end—voicebots can trigger reminders, offer payment options, and prioritize recovery based on response. This brings structure and intent-detection into an otherwise repetitive process.

4. Real-Time Agent Visibility & Quality Monitoring

Supervisors can monitor calls in real-time across regions, track NPS, evaluate agent sentiment, and identify training gaps, backed by speech analytics across thousands of calls daily.

5. Cross-Sell & Upsell Enablement

Multi-product NBFCs have leveraged Ozonetel to pitch top-up loans, cross-sell insurance, or renew deposits through contextual voice interactions, leading to consistent conversion rates of 10% or higher on warm voice leads.

Why Ozonetel Voicebot

Unlike off-the-shelf bots, Ozonetel’s voice AI agents are built specifically for high stakes, use cases in BFSI:

- Natively Integrated: Works out-of-the-box with CRMs, loan origination systems, and verification engines—no heavy custom dev cycles.

- Language Smart: Supports 11+ Indian languages with tone and intent recognition, making it ideal for regional customers and rural penetration.

- Built for Scale: Proven to handle 2B+ calls annually and 100K+ daily agent logins—used by India’s largest Banks, NBFCs,

- Intelligent Automation: From real-time sales assist to collections, feedback, or service, Ozonetel voicebots are configurable per product, region, or lifecycle stage.

- Actionable Analytics: With features like call scoring, interruption detection, and keyword tracking, you don’t just automate—you improve.

Conclusion: How Ozonetel Can Help

Legacy IVR systems are no longer enough. They’re rigid, impersonal, and can’t keep up with the scale or expectations of modern customer service. AI-powered IVR solves that, and Ozonetel offers everything you need to make that shift, fast and without friction.

Ozonetel’s AI IVR platform is built for real-world use—whether you’re looking to automate high-volume support, scale multilingual self-service, or drive more efficient call routing. As a fully cloud-based, API-first solution, it gives you the flexibility to deploy, test, and iterate quickly across any industry or use case.

With Ozonetel, you get:

- End-to-end AI IVR workflows using an intuitive visual builder.

- Real-time call insights including sentiment analysis, transcripts, and summaries.

- Smart routing with full agent context for seamless escalations.

- Multilingual, human-like voice support across regions.

- Plug-and-play integrations with your CRM, ticketing, and analytics stack.

- Fully secure and scalable infrastructure, ready for enterprise deployments.

Conclusion: Why Ozonetel is a Leading Cloud Contact Center Platform

Ozonetel is more than just a cloud contact center—it’s a complete, enterprise-grade CX platform built for speed, intelligence, and scale. It enables businesses to launch quickly, streamline operations, and elevate both customer and agent experiences without the burden of complex setup or third-party dependencies.

What Sets Ozonetel Apart:

- Built-in Telephony: Fully integrated voice stack with zero reliance on third-party vendors

- Fast, No-Hassle Deployment: Go live with minimal IT intervention

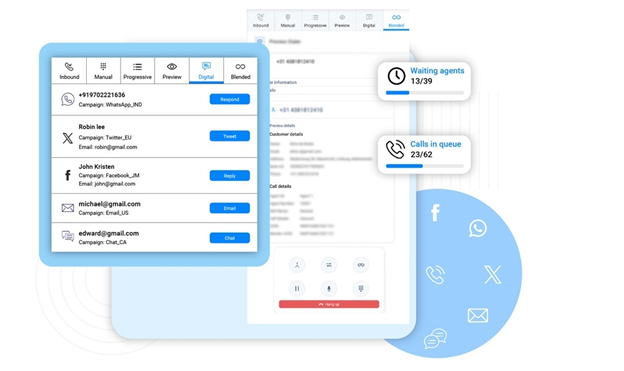

- Omnichannel Engagement: Connect seamlessly across voice, chat, WhatsApp, social, email, and more

- Real-Time Visibility: Live dashboards and in-depth analytics for smarter decisions

- AI at the Core: Conversational intelligence, agent assist, auto QA, and smart routing

- Transparent, Scalable Pricing: Grow without worrying about hidden charges

- Remote-Ready Infrastructure: Maintain high agent performance from anywhere

With Ozonetel, businesses get a unified platform that brings together automation, analytics, and agility to orchestrate connected experiences. It helps you capture more value from every interaction—without adding complexity.

Reinvent Banking CX with Voice AI

Frequently Asked Questions

Voicebots reduce wait times, automate routine queries (such as KYC, balances, and payments), and provide 24/7 multilingual support. They help banks engage faster, personalize at scale, and free agents for high-value conversations, leading to better CX and lower operational costs.

Ozonetel offers ready-to-deploy voicebots built for BFSI use cases, including KYC, collections, renewals, and more. With deep CRM integrations, multilingual support, and speech analytics, banks can go live quickly and drive real results, such as faster conversions, over 70% query automation, and improved CSAT.