- Resources

- TRAI 160 Series Deadline: How to Ensure Compliant, Trusted Voice Communication

TRAI 160 Series Deadline: How to Ensure Compliant, Trusted Voice Communication

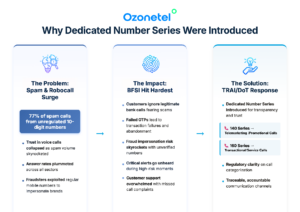

Till the second half of 2024, spam calls, robocalls, and call-based fraud had surged across India, severely eroding customer trust and overall user experience. Multiple surveys revealed that a majority of mobile subscribers received unwanted or “pesky” calls every day, with 77% reporting three or more such calls daily, even after registering on Do-Not-Disturb (DND) lists.

This constant exposure to spam fundamentally changed how customers responded to calls. Users became hesitant to answer unknown numbers – impacting not just marketing outreach, but also critical service communication. As a result, enterprises increasingly saw missed OTPs, ignored transaction alerts, failed interactions, and declining brand credibility, particularly in industries that rely heavily on voice for time-sensitive communication.

In this article, we will explore:

The Regulatory Response: Purpose-Based Numbering

For industries like banking, financial services, and insurance (BFSI) where voice is critical for security, authentication, and trust, this breakdown had a direct impact on both customer experience and business continuity.

To address this growing trust deficit, TRAI and the Department of Telecommunications (DoT) introduced dedicated numbering series -140 and 160 – under the Unified Communications Compliance (UCC) framework.

The principle was simple but powerful-

- 160 series → Service and transactional voice calls

- 140 series → Promotional and telemarketing voice calls

This clear separation enables customers to instantly recognize the purpose of a call, allows telecom operators to enforce controls at the network level, and gives regulators stronger tools to detect, block, and penalize misuse.

As a result, In September 2024, the complaints against unregistered telemarketers were 3.12 lakhs, which fell to 2.16 lakhs in the following month. In October this year, there were only 39,000 complaints against registered telemarketers as compared to 71,000 in September.

What is the 160 Number Series?

The 160 number series is a dedicated numbering range introduced by the Department of Telecommunications (DoT), under TRAI’s UCC framework, exclusively for service and transactional voice calls.

These include:

- OTP and authentication calls

- Transaction confirmations

- Account and policy alerts

- Fraud warnings and risk notifications

Unlike regular 10-digit numbers or promotional calling ranges, 160 numbers are reserved only for verified, non-promotional use cases and are allocated to KYC-verified, regulated entities such as banks, NBFCs, fintechs, insurers, government bodies, and other authorized institutions.

How the 160 Number Series Works

Let’s understand how TRAI’s 160 number series mandate is being implemented.

Entity Verification

Only registered and verified Principal Entities (such as banks, NBFCs, fintechs, insurers, government bodies, and regulated service providers) are eligible to use the 160 series.

Purpose-Based Allocation

Calls placed using 160 numbers are strictly mapped to service or transactional use cases—not promotions, offers, or sales outreach.

Network-Level Validation

Telecom networks validate that calls originating from 160 numbers match approved templates and registered entities. Any deviation can trigger blocking or penalties.

Clear Identification for Customers

Since 160 is a known transactional prefix, subscribers can immediately recognize these calls as legitimate service communications, not marketing calls.

Stronger Enforcement & Blocking

If a 160 number is misused, regulators and operators can quickly identify, trace, and block it—prevent large-scale abuse.

How to Get a 160 Series Number

Let’s take a look at how businesses can get a TRAI-mandated 160 series numbers.

Confirm eligibility

Only verified and regulated entities such as banks, NBFCs, insurers, fintechs, and government bodies are eligible to use the 160 series.

Complete entity verification

The organization must complete entity registration and KYC verification as required by telecom and regulatory guidelines.

Define approved use cases

The 160 series can be used only for service and transactional calls like OTPs, alerts, and fraud notifications—not for promotions or sales.

Provision through an authorized provider

The 160 number is allocated via telecom service providers or authorized platforms that support TRAI–DoT compliance.

Enable compliant calling

Once assigned, all calls are validated at the network level to ensure they follow approved purpose and usage rules.

What is the 140 Number Series?

The 140 number series is a dedicated numbering range mandated by TRAI for promotional and telemarketing voice calls. It is designed to clearly identify marketing calls and ensure they are delivered only to customers who have provided the required consent.

How the 140 Number Series Works

- Used exclusively for promotional calls such as offers, sales outreach, and campaigns

- Mandatory registration of entities, headers, and call templates on DLT platforms

- Consent-based delivery, aligned with customer preferences and DND settings

- Strict monitoring and blocking if the series is misused or consent rules are violated

How to Get a 140 Series Number

Let’s see how a business can acquire 140 number series for customer communication.

Choose a registered telemarketer

A 140 number is issued through a registered telemarketer or platform provider (such as Ozonetel).

Ensure DLT registration

The telemarketer must be registered on the DLT portal of at least one Telecom Service Provider (TSP) to provision a 140 number.

Register your entity on DLT

Your business (Principal Entity) must have a valid Entity ID on the DLT platform for voice or SMS communication.

Assign the 140 number to your Entity ID

Once allocated, the telemarketer links the 140 number to your Entity ID on the DLT portal.

Approve headers and templates

Register and approve your voice headers and call templates, and ensure calls are made only with valid customer consent.

Why the 140 Number Series Matters

The 140 series brings transparency and control to promotional voice communication. It protects customers from unwanted calls while enabling businesses to run compliant, scalable outreach without relying on random or personal mobile numbers—helping improve trust, deliverability, and long-term brand credibility.

Key Differences: 140 Series vs 160 Series

| Aspect | 140 Series | 160 Series |

|---|---|---|

| Primary Use | Promotional / telemarketing voice calls | Service & transactional voice calls (OTP, alerts, account notifications) |

| Who Should Use | Registered telemarketers and businesses approved for promotional calling | Verified banks, BFSI institutions, government bodies, and regulated entities |

| Delivery & Screening | Subject to telemarketing consent / opt-out rules; may be throttled if abused | Stricter verification and routing; prioritized legitimacy and security |

| Spoofing Risk | Extremely low due to telco-level whitelisting | Near zero with DoT allocation + DLT-based validation |

| Call Traceability | End-to-end traceability via DLT platforms | Immutable traceability with stronger audit controls |

| DND Enforcement | Mandatory DND scrubbing; calls blocked for DND users without consent | Exempt from DND blocking for legitimate service calls to existing customers |

| Consent Requirement | Explicit opt-in required for promotional outreach | Implied consent for account holders; usage strictly monitored |

| Action on Misuse | Progressive penalties: template suspension → number suspension → blacklist | Immediate suspension, blacklisting, and regulatory escalation (RBI/SEBI, where applicable) |

| Real-World Impact | Noticeable reduction in spam complaints post enforcement | Significant improvement in OTP delivery and pickup rates |

The Cost of Using 140 Instead of 160

When enterprises use 140 numbers for transactional or service calls, they expose themselves to serious consequences:

Regulatory impact

- Call blocking by telecom operators

- Suspension of headers or entities

- Penalties or disconnection of voice resources

- Blacklisting across operators under TCCCPR norms

Customer experience impact

- Customers ignore calls assuming they are promotional

- OTPs and alerts go unanswered

- Transactions fail or get delayed

- Support escalations and churn increase

For BFSI and regulated industries, this directly affects revenue continuity, compliance posture, and customer trust.

Adopt the Mandatory 160 Series with Ozonetel

With early-2026 compliance deadlines approaching, enterprises must operationalize 160-series calling without delay.

Ozonetel enables quick, seamless activation of the 160 series with secure, verified call routing and a trusted caller identity customers instantly recognize. Intelligent auto dialers automatically route service and transactional calls through the correct number series, ensuring timely delivery of critical communications such as OTPs, alerts, and confirmations—while improving pickup rates at scale.

By embedding purpose-based numbering directly into call workflows, Ozonetel helps enterprises meet TRAI guidelines effortlessly, reduce fraud risk, and deliver a reliable, trusted voice experience.

Get 160-Series Ready with Ozonetel

Frequently Asked Questions

Ozonetel’s cloud-native architecture enables businesses to go live in days—not weeks or months like many traditional enterprise platforms. With minimal IT dependencies and simple API integrations, deployment is frictionless even at scale. In contrast, Genesys implementations often involve complex setup cycles and customization layers that can extend timelines, especially for mid-market or multi-location rollouts.

Ozonetel’s 24/7 customer support is known for its hands-on, personalized approach. During high-traffic periods or service disruptions, businesses often cite Ozonetel’s faster response times and proactive resolution compared to Genesys’ ticket-driven escalation model. The local presence and dedicated success teams make Ozonetel a more agile partner in critical moments.

Genesys offers extensive analytics capabilities, but Ozonetel bridges the gap with real-time dashboards, customizable reports, and AI-powered conversation intelligence. Users gain actionable visibility into agent performance, call quality, and customer sentiment without needing external tools or data teams. Ozonetel’s unified analytics also eliminate silos—something that’s harder to achieve with Genesys’ multi-module architecture.

Ozonetel is built to scale horizontally. Whether it’s a startup expanding across regions or an enterprise managing thousands of concurrent interactions, the platform adapts without costly migrations or infrastructure overhauls. Genesys offers strong scalability too, but with higher costs, licensing complexities, and longer configuration cycles that can slow down agility as you grow.

Genesys has long been associated with advanced automation, but Ozonetel has quickly closed the gap with AI-first tools like conversational intelligence, real-time agent assist, and customer journey automation. What sets Ozonetel apart is accessibility—AI is embedded natively into the platform, making it easier and faster for teams to deploy without external integrations or added costs.