- Resources

- Top P2P lending Platforms and Apps in India

Top P2P lending Platforms and Apps in India

Peer-to-peer (P2P) lending provides a simple and affordable alternative to traditional bank loans. These platforms connect borrowers directly with lenders, enabling quick access to credit at lower interest rates while offering lenders better returns by removing traditional intermediaries like banks or financial institutions.

They are ideal for small business owners or individuals seeking flexible loan options. P2P lending platforms use advanced tools to assess creditworthiness. With many platforms available, we’ve compiled a list of the top ten P2P lending options to help you find the best fit for your needs.

Overview

Here’s a quick look at the top P2P lending platforms in India, each offering unique features to fit different lending and borrowing needs.

| Platform | Best For | Key Features |

|---|---|---|

| LenDenClub | Investors looking to scale lending | Wide loan categories, flexible tenures, payout and reinvestment options |

| Lendbox | Retail investors looking for structured P2P investing | Verified borrowers, portfolio dashboard, diversification options |

| Faircent | Borrowers and lenders needing multiple loan options | Diverse loan categories, zero collateral loans, fully digital process, flexible tenures |

| Mobikwik Xtra | Small-ticket, app-based investors | Micro-lending exposure, borrower diversification, app-integrated investing |

| IndiaP2P | Investors seeking monthly income | Diversified plans, monthly payouts, secure onboarding |

| I2i Funding | Short-tenure, small-ticket lending | Small loan sizes, faster repayment cycles, in-house underwriting |

| Finzy | Quick personal loans and simple lending | Fast disbursals, risk-based pricing, simplified borrowing, automated repayments |

| Cred Mint | Low-risk, curated investors | Integrated with CRED ecosystem, regulated structure, stable returns, portfolio tracking |

| Rupee Circle | Risk-graded P2P investors | Proprietary credit scoring, unsecured loans, flexible repayments, digital risk assessment |

| RangDe | Social impact and purpose-led investors | Micro-loans for rural communities, transparent borrower stories, impact-focused lending |

Key Takeaways

- P2P lending platforms in India connect borrowers and lenders through RBI-regulated digital platforms, enabling faster access to credit.

- RBI-approved P2P lending companies follow the NBFC-P2P framework, ensuring transparency, compliance, and data protection.

- The best P2P lending platforms in India use technology-driven credit assessment models to evaluate borrower risk effectively.

- P2P lending apps offer quicker loan processing and flexible investment options compared to traditional banks.

- Returns from P2P loan apps can be attractive, but investors should consider default risk, liquidity constraints, and tax implications.

What is Peer-to-Peer Lending?

Peer-to-peer lending is a direct, digital match between individual borrowers and lenders without traditional financial institutions acting as intermediaries. It offers easier access to credit for borrowers and attractive interest returns for investors.

P2P loan apps typically process applications faster than banks, with funds often disbursed within days of approval. This makes P2P lending a practical option for individuals and small businesses seeking timely and flexible financing.

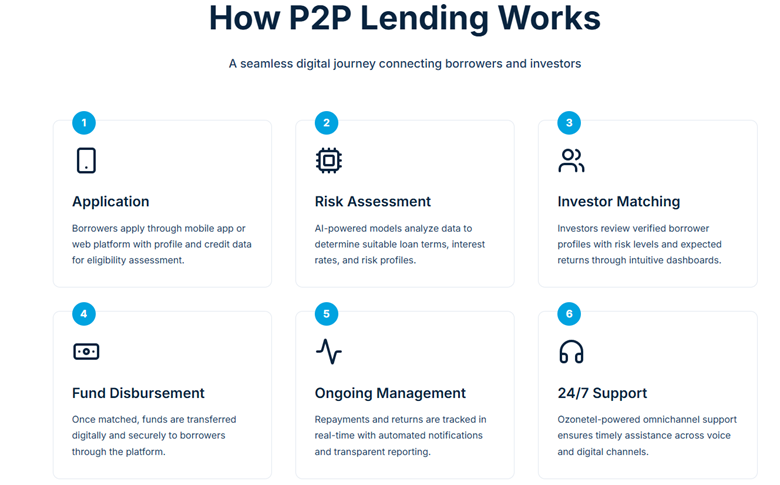

P2P Lending Process Explained

Top 10 P2P Lending Platforms

Now that you have a good understanding of what peer-to peer lending is and how it works, here are some of the top 10 P2P lending companies that you can opt for:

LenDenClub

LenDenClub is a RBI-registered peer-to-peer lending platform with a wide retail investor base and strong loan disbursement history. The platform offers multiple loan types (personal, business, medical) and operates fully online. So far, the platform has disbursed over ₹17,366 crore in loans and has over 3 crore registered users.

Key Features

- Loan tenures range from 1 month to 36 months

- Zero withdrawal fees on invested funds

- Options for monthly payouts or auto-reinvestment

- Platform fees range between 0% and 4% of the amount lent

Lendbox

Lendbox is licensed by the Reserve Bank of India under the NBFC-P2P model. It focuses on high-quality borrower profiles and a user-friendly dashboard, making it a preferred choice for retail investors.

- Loan tenures range from 1 month to 36 months

- Interest earned through borrower repayments

- Platform fees range between 0%–4% of amount lent

- Flexible investment options enabling diversification

- Focus on verified, creditworthy borrowers

FairCent

Faircent is one of India’s earliest RBI-registered NBFC-P2P platforms which offers multiple loan categories for borrowers and diversified investment opportunities for lenders. The platform is suitable for both suitable for both short-term and longer-term financing needs.

Key Features

- Loan categories include personal, business, marriage, and property-backed

- Loan tenures range from 6 to 36 months

- 100% online process, no physical documentation

- Zero collateral loans for eligible borrowers

- Web and mobile app access available

MobikwikXtra

Mobikwik Xtra is a P2P-backed investing feature within the Mobikwik app that enables users to earn returns on micro-lending investments. An investment as small as ₹10,000 can be distributed across more than 100 borrowers, helping investors diversify risk,

Key Features

- Access to detailed borrower profiles

- Loan tenure from 3 months to 2 years

- Suitable for small-ticket investors

- Integrated within Mobikwik app

- provides up to 14% returns per annum

IndiaP2P

IndiaP2P is an RBI-certified NBFC-P2P platform offering diversified lending plans, including monthly income options for investors. India P2P provides advanced security measures for safe and secure transactions.

Key Features

- Minimum investment typically starts from ₹10,000

- Multiple investment plans with diversified risk exposure

- Provides monthly payouts

- Lenders can earn up to 18% per annum

- Loan tenures up to 36 months

- Secure digital onboarding and monitoring

I2iFunding

i2i Funding is an online peer-to-peer lending platform that focuses on small-ticket, short-tenure loans designed for borrowers with a higher likelihood of repayment. The platform supports unsecured personal, business, and specific consumer-purpose loans.

Key Features

- Small-ticket loans starting from ₹1,000 to ₹5,000 per loan

- Short-tenure lending focused on faster repayment cycles

- In-house underwriting team for detailed credit assessment

- Physical verification conducted for select borrower profiles

Finzy

Finzy is a regulated P2P lending platform offering simplified personal loan products with a borrower-friendly experience. The platform makes the entire borrowing process simple and user friendly. Borrowers can avail loan in as little as 48 hours

- Offers loans from ₹50,000 to ₹5 Lakh

- Rigorous credit assessment process

- Loan tenures range from 6 to 24 months

- Automated repayment tracking

- risk-based pricing system for the borrowers

CRED Mint

CRED Mint is an investment offering integrated within the CRED ecosystem, developed in partnership with Liquiloans. It enables CRED members to participate in peer-to-peer style lending through a curated and regulated structure.

Key Features

- Investment range from ₹1 lakh to ₹50 lakh

- Daily portfolio tracking directly within the CRED app

- Curated borrower selection through a regulated lending structure

- Returns of up to 9% per annum

- Emphasis on lower-risk profiles

RupeeCircle

RupeeCircle is an RBI-registered NBFC-P2P lending platform that directly connects borrowers with investors through a technology-driven marketplace. The platform has over 306,000 registered users, including 86,000+ active investors.

Key Features

- Minimum investment starts from ₹5,000, across single or multiple loans

- Proprietary credit scoring model assigns risk grades and interest rates

- Focus on unsecured personal loans

- Flexible repayment schedules with loan tenures up to 36 months

- End-to-end digital borrower risk assessment

RangDe

RangDe is India’s first peer-to-peer social investment platform, focused on expanding access to credit for underserved rural entrepreneurs. It enables individuals to lend directly to farmers, artisans, and small business owners, helping build sustainable livelihoods while delivering meaningful, impact-led returns.

Key featuers

- Minimum investment starts from ₹500

- Focus on micro-loans for underserved and rural communities

- Longer-term lending designed for sustainable livelihood impact

- Transparent borrower stories and clearly defined use cases

- Strong emphasis on social returns over high financial yields

Risks in Peer-to-Peer Lending and How to Mitigate Them

There are multiple advantages of P2P lending, but it also comes with certain inherent risks that investors and borrowers should consider. For example, a major risk is borrowers failing to repay their loans.

To mitigate this risk, individuals can diversify their investments across multiple borrowers, spreading the exposure and minimizing the risk of defaults on the overall returns. A few other risks associated with P2P Lending are:

- Liquidity Risk

P2P lending typically involves fixed loan tenures, which means investors may not be able to withdraw funds before loan maturity. To manage this, investors should maintain adequate emergency funds in liquid instruments outside their P2P portfolio. - Macroeconomic Risk

Economic slowdowns or financial disruptions can affect borrowers’ repayment capacity, increasing the risk of defaults. Diversifying investments across multiple borrowers, asset classes, and industries can help reduce the impact of broader economic fluctuations. - Platform Risk

Poorly managed platforms may expose investors to operational issues or data security risks. Choosing well-established, regulated platforms and reviewing their governance and security practices can help mitigate this risk. - Regulatory Risk

Changes in regulatory policies may impact how P2P platforms operate. Investing through platforms that strictly comply with RBI guidelines helps ensure alignment with current regulations and reduces regulatory uncertainty.

How Do Taxes Work in P2P Lending?

P2P lending allows investors to earn interest on the amount they lend. Thus, interest income from peer-to-peer lending is taxed, just like interest earned from other instruments such as FDs.

Interest gained via peer-to-peer lending is classed as ‘Income from Other Sources.’ It is added to the lender’s income and taxed at the appropriate tax bracket. So, if someone is in the 30% tax band, he will pay 30% tax on his interest earnings.

Factors to Consider Before Investing in P2P Lending in India

Before investing in P2P lending, it’s important to understand the key factors that influence risk, returns, and liquidity

- Platform Regulation: Choose RBI-registered NBFC-P2P platforms to ensure compliance, transparency, and investor protection.

- Risk Diversification: Spread investments across multiple borrowers, loan tenures, and risk grades to reduce exposure to defaults.

- Expected Returns vs Risk: Higher returns often come with higher risk. Evaluate whether the risk level aligns with your financial goals.

- Liquidity Constraints: P2P investments are typically locked in until loan maturity. Ensure you have sufficient liquid funds elsewhere.

- Credit Assessment Process: Review how the platform evaluates borrower creditworthiness and assigns risk grades.

- Fee Structure: Understand platform fees, facilitation charges, and any exit-related costs before investing.

- Tax Implications: Interest earned is taxable as Income from Other Sources and taxed according to your income slab.

How Ozonetel Supports Superior CX for NBFCs and P2P Lending Platforms

Ozonetel’s unified CX platform helps NBFCs and P2P lending platforms manage high-volume borrower and investor interactions across the lending lifecycle—from lead capture and verification to servicing and collections.

Improve Lead Conversion and Borrower Reach

NBFCs and P2P platforms use Ozonetel to respond quickly to digital loan inquiries through automated calling and CRM-dialer integration. This ensures timely borrower contact, helps reduce lead response times by up to 99%, and improves loan conversion rates through faster follow-ups.

Streamline Loan Onboarding and Verification

Ozonetel supports loan assessment, KYC verification, and customer outreach at scale. With intelligent call routing and automation, lending teams can reach large borrower volumes efficiently—helping leading NBFCs engage with over 1 million customers per month while reducing turnaround time by up to 95%.

Enhance Borrower and Investor Support

Through intelligent, multi-level, multi-lingual IVR, NBFCs and P2P platforms can automate routine service queries such as application status, repayment schedules, and account information. Priority routing and scheduled callbacks ensure high-value borrowers and investors are connected to agents quickly, even during peak demand.

Support Collections and Repayment Communication

Ozonetel enables automated EMI reminders, payment notifications, and follow-ups across voice and digital channels—helping lenders improve repayment rates while maintaining respectful, compliant customer communication.

Conclusion

P2P lending offers borrowers faster access to credit and gives investors new ways to diversify returns. With several RBI-regulated platforms available in India, the right choice depends on individual goals, risk appetite, and preferred loan tenure. Reviewing platform features and understanding the risks can help both borrowers and investors make informed decisions.

Explore Ozonetel’s CX platform built for lending, onboarding, and collections

Prashanth Kancherla

Chief Operating Officer, Ozonetel Communications

Over the past decade, Prashanth has worked with 3000+ customer experience and contact center leaders...

Chief Operating Officer, Ozonetel Communications

Over the past decade, Prashanth has worked with 3000+ customer experience and contact center leaders to comprehensively understand the need for effective and efficient customer communications at every step of their journey with a brand. Deeply embedded in today’s CCaaS ecosystem, he has been instrumental in Ozonetel's growth and contributed in various roles including product management, sales, and solution architecture.

Frequently Asked Questions

Ozonetel’s unified CX platform enables lenders to streamline operations, improve customer experience, and stay compliant with regulatory standards. With secure solutions, lenders can respond quickly to leads, enhance customer support, and automate debt collection processes efficiently.

P2P investing allows you to earn higher returns than traditional investments while helping individuals or businesses in need of funding. It’s a flexible option that enables you to diversify your investment portfolio and choose projects that align with your goals.

Before starting your P2P lending journey, it’s essential to understand the risks involved, including borrower defaults and platform security, and review the platform’s performance track record. Research each platform’s due diligence process and loan recovery policies to make informed decisions.

Investment limits in P2P lending vary by platform and depend on local regulations, which may set minimum and maximum investment amounts. Always check platform-specific guidelines and assess your risk tolerance before committing funds.

P2P platforms provide a streamlined way to connect with vetted borrowers, manage investments, and track returns. They offer transparent tools for evaluating borrower risk and often handle payment collections, making the lending process more convenient.

Some of the leading P2P platforms in India include Faircent, LenDenClub, and RupeeCircle. These platforms are known for providing reliable borrower verification processes, ease of use, and robust investor support services.